Corporate Governance

(As of August 8, 2025)

Kioxia Group is reinforcing our corporate governance processes in order to increase our corporate value.

Basic Approach to Corporate Governance

The aim of Kioxia Group’s governance is to enhance the transparency and efficiency of management through the establishment of an internal control system for the Group, ensure risk management and compliance with laws and regulations, and continuously increase corporate value as one of the world's largest flash memory players by increasing the speed of management through cooperation from supervision to execution.

The Group strives to ensure the rights and equality of shareholders and investors by appropriately disclosing information and engaging in constructive dialogue. The Group will continue to maintain and improve its governance system in order to promote appropriate cooperation through similar information disclosure and dialogue for the mutual benefit of all stakeholders related to the company, such as employees, customers, business partners, creditors, and local communities.

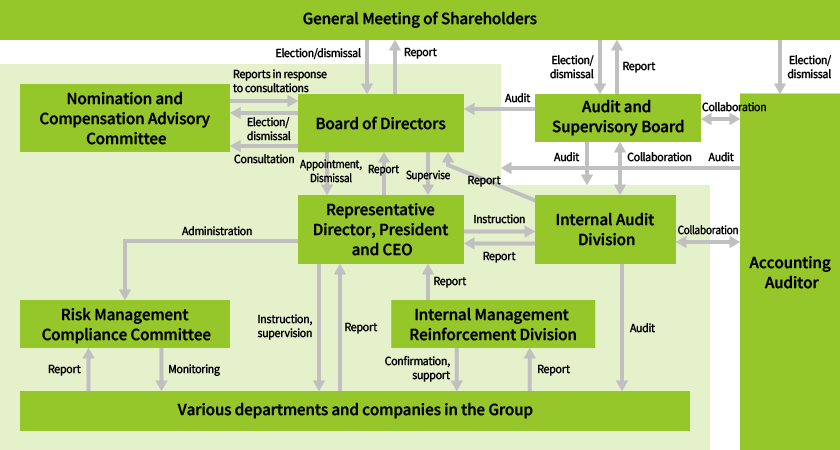

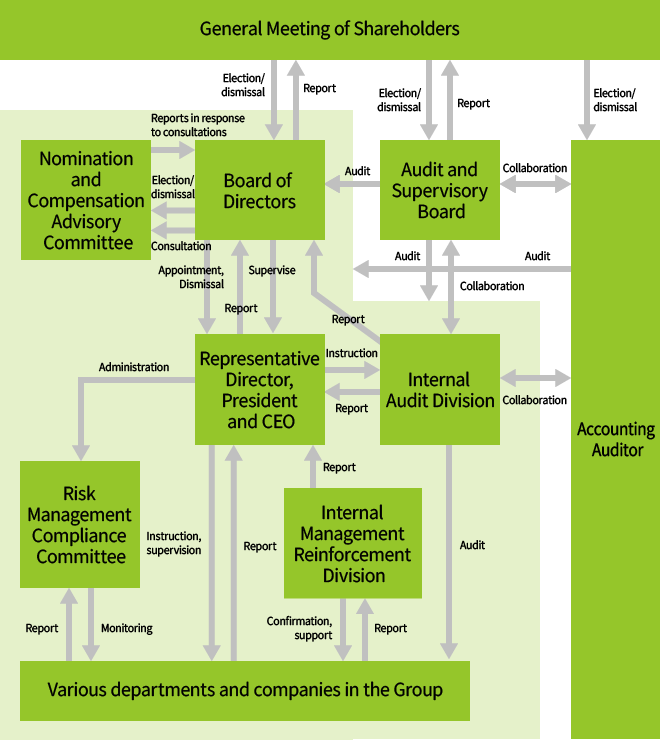

Corporate Governance Structure

Kioxia Holdings Corporation is a company with a Board of Statutory Auditors. We have developed a group governance structure in which the performance by directors of their duties is audited by our statutory auditors (Audit & Supervisory Board members).

The Board of Directors is the main body of governance for the Group. Composed of six directors, the board makes decisions on the overall execution of the group’s business and reports on the status of each director’s execution of management duties in accordance with the rules of the Board of Directors, authority standards, and other internal regulations.

As a general rule, the Board of Directors meets once a month, and when there is an urgent matter to be resolved it meets on an ad hoc basis (however, the Board of Directors holds two regular meetings in May, August, November, and February, when resolutions are made regarding financial results).

In addition to clearly stipulating matters to be resolved and reported in the rules of the Board of Directors, by having executive officers appointed by the Board of Directors responsible for the execution of duties, the company has achieved management supervisory functions by the Board of Directors and separation of executive functions.

- Please see the following link for further details on the Managements of Kioxia Holdings Corporation.

Kioxia Group's Corporate Governance Process and Responsibilities

Appointment and Dismissal of Directors and Executive Officers

In addition to discussing and examining the qualifications, experience, and achievements of candidates for directors and Audit & Supervisory Board members, the Board of Directors comprehensively considers the balance of knowledge, experience, and abilities that the Board of Directors should possess, as well as balancing diversity and appropriate size, and nominates persons who are considered suitable for the position.

The Board of Directors appoints executive officers based on comprehensive consideration of their character and insight, work experience and achievements, ability to perform their duties, and understanding of the company's business.

In the event that an executive officer engages in fraudulent or unfair conduct, or if it is found that there is a problem with their eligibility, the Board of Directors shall consider the matter and resolve to dismiss the officer if they are found to be incompetent.

The company has established the Nomination and Compensation Advisory Committee as a committee to deliberate on policies and criteria (independence criteria, term of office, qualification conditions, etc.) for the appointment and dismissal of directors, as well as policies for the selection and dismissal of the representative director, CEO & president and executive chairperson, and to consult the Board of Directors. The committee chairperson and a majority of the members of the Nomination and Compensation Advisory Committee are independent officers to ensure the committee’s independence.

Composition of the Nomination and Compensation Advisory Committee

|

Chairperson |

Hiroshi Suzuki (Independent officer) |

|---|---|

|

Member |

Michael R. Splinter (Independent officer) |

|

Member |

Nobuo Hayasaka (President, Chief Executive Officer and Representative Director) |

Internal Control

The Group strives to enhance its internal control system for the purposes of ensuring the effectiveness and efficiency of management, the reliability of business and financial reporting, as well as legal compliance and risk management.

Group companies are required to establish internal control systems, regardless of whether they are large or non-large companies under the Companies Act, or their country of incorporation.

Basic View on Measures for Eliminating Anti-Social Forces and Status of Development

The company stipulates its basic approach to the elimination of anti-social forces in the Kioxia Group Standards of Conduct“ 2. Fair Business Operations, 2-1. Fair Competition, Prevention of Transactions with Antisocial Groups,” which stipulates that the Group will avoid any involvement or association with antisocial groups.

Director Remuneration

Based on its Basic Policy on Corporate Governance, the company has established a remuneration system for officers designed to realize the continuous enhancement of corporate value, and to ensure that the functions of business execution and management supervision are appropriately fulfilled. This remuneration plan for officers will be updated periodically to reflect the company’s business growth and the market environment.

|

View on remuneration level |

The level of remuneration is designed to ensure appropriate remuneration competitiveness as a global company to attract and retain highly capable executive talent who drive the company’s business. Specifically, the level is determined by referencing the remuneration levels of domestic and global companies in the semiconductor industry and other related industries. |

|---|---|

|

Remuneration structure |

Remuneration for directors who concurrently serve as executive officers is structured as follows, to reflect their responsibility for medium- to long-term performance and for enhancing corporate value. Remuneration for directors who do not concurrently serve as executive officers is structured as follows. |

|

Method of determining remuneration for officers |

To ensure objectivity and transparency, the Board of Directors shall delegate the determination of individual remuneration amounts for directors to the Nomination and Compensation Advisory Committee, which is a voluntary committee chaired by an independent officer and composed of three or more directors, the majority of which are independent officers. |

|

Malus and clawback provisions |

In the event of serious misconduct or violation of laws and regulations on the part of a director, the company has established a “malus provision” under which, by resolution of the Board of Directors, all or a portion of the units of performance-linked remuneration and continuous service/performance-linked stock-based remuneration may be forfeit, and a “clawback provision” under which the company may request the return of all or a portion of money or shares paid. |

Outside Directors

|

Name |

Reasons for Appointment |

|---|---|

|

Hiroshi Suzuki |

He has been appointed as an outside director because he has extensive knowledge on management strategy and global management, having served as a director and President & CEO of HOYA Corporation for many years, and is receptive to opinions from a wide range of perspectives regarding the management of the Group. He has been designated as an independent director because it has been deemed that there is no matter that may cause a conflict of interest with the general shareholders of the company based on his background, etc., and that he can appropriately execute his duties as a third party that ensures independence. |

|

Michael Splinter |

In addition to having served for many years managing a global overseas listed company and having extensive experience in the international semiconductor industry, he has been appointed as an outside director because he is expected to make a valuable contribution to the discussions of the company's basic strategy and appropriately supervise the management of the company using his experience supervising listed companies as Chairman of the NASDAQ. He has been designated as an independent director because it was deemed that there is no matter that may cause a conflict of interest with the general shareholders of the company based on his background, etc., and that he can appropriately execute his duties as a third party that ensures independence. |

The above two persons meet the standards of independence established by Japanese financial instruments exchanges such as the Tokyo Stock Exchange.

The Legal Affairs Division, which is the administrative office of the Board of Directors, provides outside directors with deliberation and explanatory materials in advance of important meetings such as the Board of Directors, and provides them with advance explanations on agenda items as necessary. Moreover, in addition to the Board of Directors, the Board of Directors Council, which is comprised of directors, including outside directors, is held with the purpose of sharing information related to the company’s business that contributes to management decisions.

Please see the following link for further details on Kioxia Holdings Group’s corporate governance initiatives.